Tag Archives: Payroll

Tax Updates: No Tax on Tips or Overtime

The recently passed One Big Beautiful Bill Act (H.R. 1) has sparked plenty of questions from employees and employers alike. Two highly publicized provisions, the “no tax on tips” and “no tax on overtime”, have led some to believe taxes will stop being withheld from paychecks right away. We want to set the recordContinue Reading

Required Year-End Reports for Businesses

At the end of each year, businesses like yours must prepare a few important reports to comply with legal and financial requirements. Here’s a brief guide to the most common end-of-year reports companies should prepare: Employee Tax Forms. These forms are important to maintain tax compliance and to report employee earned income. W-2 Forms:Continue Reading

Impact of the New Overtime Rule During the Upcoming Compensation Season

As the year comes to an end, businesses are preparing for the year-end review process, and compensation plans are top of mind. With potential raises, bonuses, and other incentives in the horizon, employers also need to address the U.S. Department of Labor’s (DOL) upcoming changes to overtime rules taking effect on January 1, 2025.Continue Reading

Providing Employees Time Off to Vote

With Election Day a couple of months away and record turnout expected in many states, it’s important for employers to understand their obligations when it comes to employee voting leave. It’s crucial to stay compliant while supporting your employees’ right to participate in elections. Providing Employees Time to Vote Employers must understand their responsibilitiesContinue Reading

Understanding the Recent Court Ruling on Tip Credits

If you own a restaurant or are involved in the hospitality industry, there’s been a recent court decision you should know about. The Fifth Circuit Court of Appeals struck down a controversial rule from the Department of Labor (DOL) known as the “80/20/30 rule.” This ruling provides relief for employers struggling with the complexitiesContinue Reading

Update On The New Federal Overtime Rule

Rule goes into effect today, for most. A Win for The State of Texas as an Employer According to Fisher & Phillips LLP, the state of Texas, as an employer, is exempt from complying with today’s new exempt salary threshold due to a Friday court order. This exemption applies solely to the state itself;Continue Reading

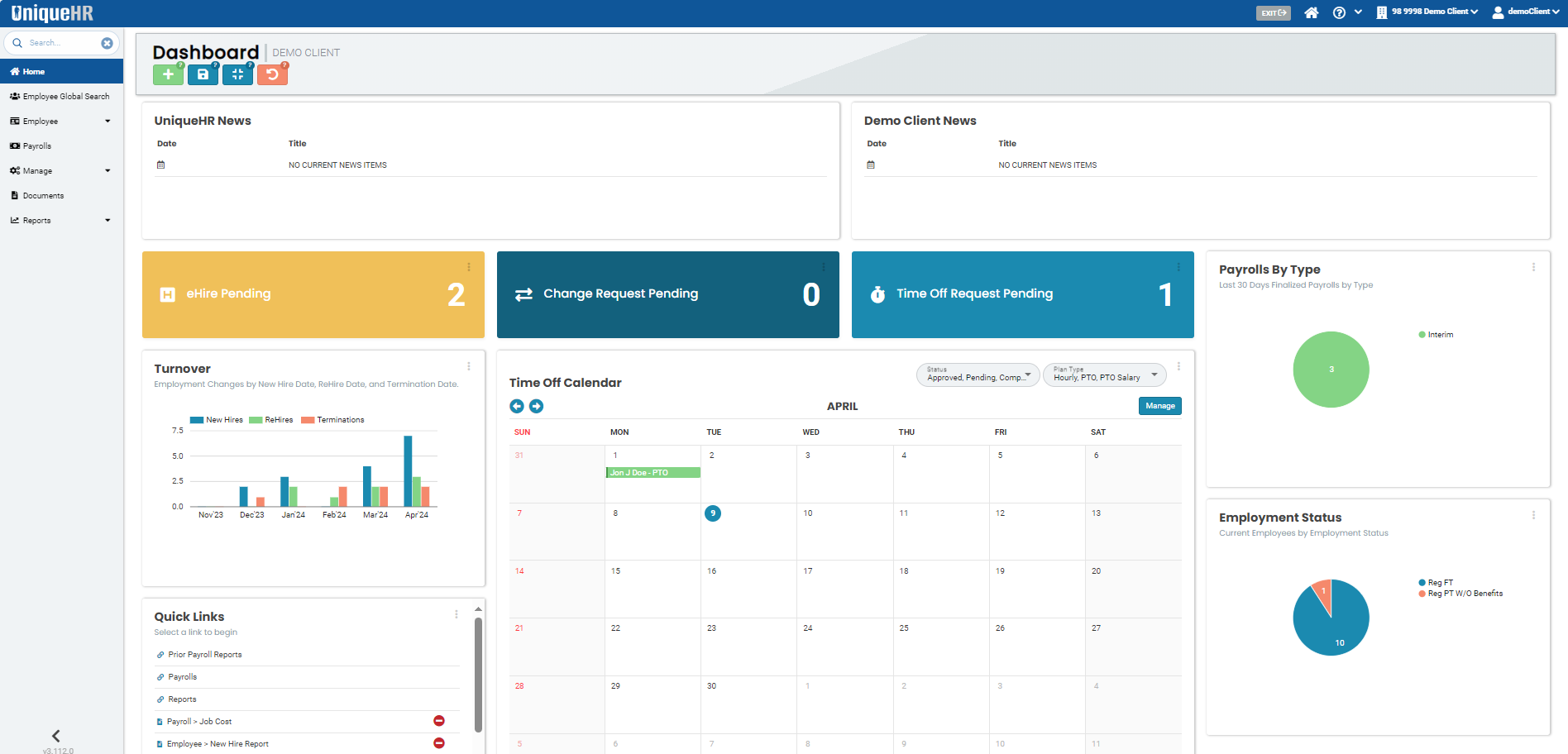

Our New Portal Improves HR Task Management Efficiency

Save more time and money while also reducing stress. Running a business can be quite overwhelming. You are working to expand and make a profit while also managing day-to-day human resources (HR) tasks. To enable you to focus your efforts on activities that actually grow your business, we created a portal that will enhanceContinue Reading

Fringe Benefits

Why acting early may save you money and risk. What are non-cash fringe benefits? Non-cash fringe benefits are benefits an employee doesn’t receive cash for but does get taxed on. Some examples of commonly used fringe benefits are gift cards, Group Term Life Insurance greater than $50,000, personal use of a company vehicle, orContinue Reading

Breaking News!

With these penalty amounts rising, companies must make sure they remain compliant with employment laws. UniqueHR can provide compliance assistance with employment laws and regulations and help your employees better understand their rights and responsibilities. Reach out today to learn more about our partnership opportunities.

With UniqueHR, filing taxes doesn’t have to be a burden

The IRS tax filing deadline is upon us again. Filing with the necessary thoroughness and meticulous care can be challenging for business owners. Still, it does not have to be with the help of UniqueHR’s PEO services. Handling payroll and payroll taxes are one of the primary services UniqueHR offers. We can take the stress of siftingContinue Reading

UniqueHR can offer your growing business peace of mind

Administrative responsibilities such as payroll, benefits, HR (human resources), risk management, and compliance can create time and financial burdens. As a result, they force an owner’s attention away from their business’s core mission and hinder potential profitability. Seeking out an experienced and reliable Professional Employer Organization (PEO) such as UniqueHR to manage these integral partsContinue Reading

PEO and the Pandemic

A new study by McBassi & Company surveyed PEO clients across the nation concerning the COVID-19 Pandemic. The results are right in line with the feedback UniqueHR received from our clients. Concerning PPP Loans: 98% of PEO clients’ PPP loan applications were successful. PEO clients were more than twice as likely to receive PPP loans–65.9%Continue Reading