Tag Archives: Small Business

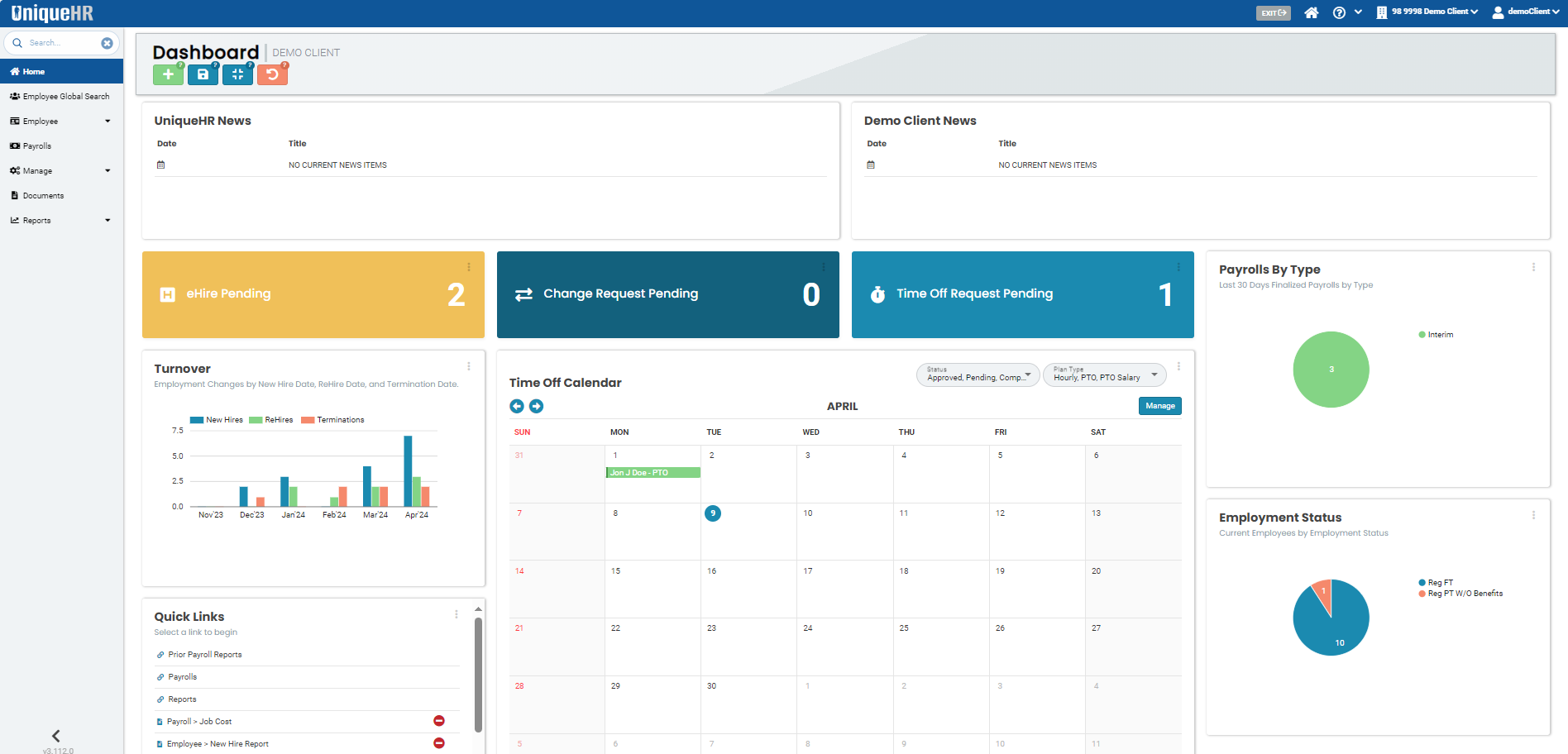

Our New Portal Improves HR Task Management Efficiency

Save more time and money while also reducing stress. Running a business can be quite overwhelming. You are working to expand and make a profit while also managing day-to-day human resources (HR) tasks. To enable you to focus your efforts on activities that actually grow your business, we created a portal that will enhanceContinue Reading

Navigating EEO-1 Reporting Season

Reporting will be open from April 30th – June 4th. It’s that time of the year again when employers are required to file their Employment Information Report, also known as EEO-1, along with their Pay Data Reports. What is an EEO-1 report? The EEO-1 report is a survey mandated by the United States Equal EmploymentContinue Reading

Fringe Benefits

Why acting early may save you money and risk. What are non-cash fringe benefits? Non-cash fringe benefits are benefits an employee doesn’t receive cash for but does get taxed on. Some examples of commonly used fringe benefits are gift cards, Group Term Life Insurance greater than $50,000, personal use of a company vehicle, orContinue Reading

Ever-Changing Compliance Regulations for Growing Businesses

Entrepreneurship For many aspiring entrepreneurs, the pursuit of independence fuels their initial desire for business ownership. While serving one’s community with valuable services often sits at the heart of their motivation, achieving profit maximization and client satisfaction entails significant responsibilities. Among these lies HR compliance laws, a non-customer-facing area that holds immense power over yourContinue Reading

VIDEO: UniqueHR – Peace of mind for small businesses

Peace of mind for small businesses Our UniqueHR team of experts helps guide you through administrative duties that are more complex and detail-oriented. Get back to strategic and revenue-building aspects of your small business with peace of mind.