Tag Archives: Compliance

New OSHA Requirement on PPE Fit

Starting next month, the Occupational Safety and Health Administration (OSHA) will require construction employers to provide Personal Protective Equipment (PPE) that properly fits each worker’s unique body type. This change, announced December 11th, is significant given the diversity of the workforce in hazardous fields, including a growing number of women, who may have facedContinue Reading

Required Year-End Reports for Businesses

At the end of each year, businesses like yours must prepare a few important reports to comply with legal and financial requirements. Here’s a brief guide to the most common end-of-year reports companies should prepare: Employee Tax Forms. These forms are important to maintain tax compliance and to report employee earned income. W-2 Forms:Continue Reading

BOIR Filing Requirement is Temporarily Blocked

On Dec 3, 2024, a federal judge in Texas granted a nationwide temporary injunction against the Corporate Transparency Act (CTA), which required all businesses operating in the US with an EIN (roughly 32.6 million) to file a Beneficial Ownership Information Report (BOIR). This report required companies to disclose the personal information of all beneficialContinue Reading

Understanding ADA Protection and Reasonable Accommodation in the Workplace

A Simple Guide for Employers October is National Disability Employment Awareness Month (NDEAM), a time to celebrate the contributions of workers with disabilities and promote inclusive work environments. This month highlights the importance of creating equal opportunities for individuals with disabilities and emphasizes the value they bring to the workforce. As a business ownerContinue Reading

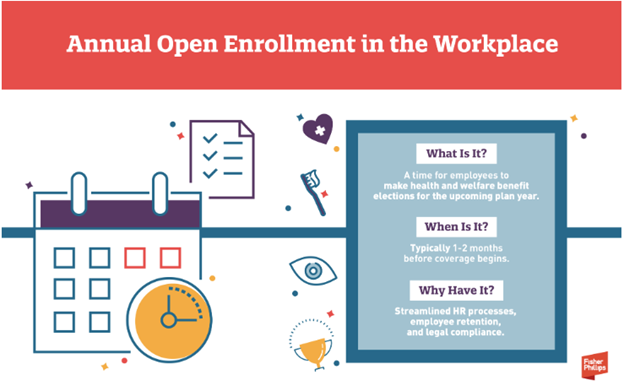

Open Enrollment Season in the Workplace

Open enrollment season is upon us, so employers are preparing to provide health and welfare benefit options for their employees during the upcoming plan year. This is an opportunity to ensure compliance with legal requirements. Here are five important considerations employers should keep in mind during open enrollment along with practical ways to helpContinue Reading

Impact of the New Overtime Rule During the Upcoming Compensation Season

As the year comes to an end, businesses are preparing for the year-end review process, and compensation plans are top of mind. With potential raises, bonuses, and other incentives in the horizon, employers also need to address the U.S. Department of Labor’s (DOL) upcoming changes to overtime rules taking effect on January 1, 2025.Continue Reading

Providing Employees Time Off to Vote

With Election Day a couple of months away and record turnout expected in many states, it’s important for employers to understand their obligations when it comes to employee voting leave. It’s crucial to stay compliant while supporting your employees’ right to participate in elections. Providing Employees Time to Vote Employers must understand their responsibilitiesContinue Reading

Employee Leave Requests During Natural Disasters

Navigating employee leave requests during natural disasters like hurricanes can be a delicate process for businesses. Employers must balance supporting their employees while following legal guidelines, especially when it comes to federal laws like the Family and Medical Leave Act (FMLA), the Uniformed Services Employment and Reemployment Rights Act (USERRA), and internal company policies.Continue Reading

Understanding the Recent Court Ruling on Tip Credits

If you own a restaurant or are involved in the hospitality industry, there’s been a recent court decision you should know about. The Fifth Circuit Court of Appeals struck down a controversial rule from the Department of Labor (DOL) known as the “80/20/30 rule.” This ruling provides relief for employers struggling with the complexitiesContinue Reading

Federal Court Strikes Down FTC’s Non-Compete Ban Nationwide

A significant legal decision has recently been made that impacts businesses across the United States. On August 20, 2024, the U.S. District Court for the Northern District of Texas struck down the Federal Trade Commission’s (FTC) rule that would have banned non-compete agreements with workers nationwide. This ruling comes weeks before the ban wasContinue Reading

Understanding Wage and Hour Issues During and After Natural Disasters

A Practical Guide for Employers For employers, navigating wage and hour issues can be complex, especially when unexpected circumstances arise. It’s important for employers to understand their obligations under the Fair Labor Standards Act (FLSA) and related state laws. Here’s a straightforward guide to help you manage these situations effectively. Paying Employees Who Aren’tContinue Reading

Reminder: Record Employee Non-Cash Fringe Benefits

What are non-cash fringe benefits? Non-cash fringe benefits are benefits an employee doesn’t receive cash for but does get taxed on. Some examples of commonly used fringe benefits are gift cards, Group Term Life Insurance greater than $50,000, personal use of a company vehicle, or health insurance premiums for 2% shareholder employees of S-Corps.Continue Reading